Please fill in your business name on the first page, and other details such as the last date in the period, and the start of the period. Please also enter the opening cash balance and the opening bank balance. If you are VAT registered, then please note that this system assumes that you are using the Cash Accounting Scheme, for which bookkeeping becomes a simple matter of just recording it as you go. David Porthouse & Co will discuss this with you at the outset. Please use a black or dark blue pen.

If you open an example of our paper-based system, then you will see that it has one week to view with cash on the left and bank transactions on the right:

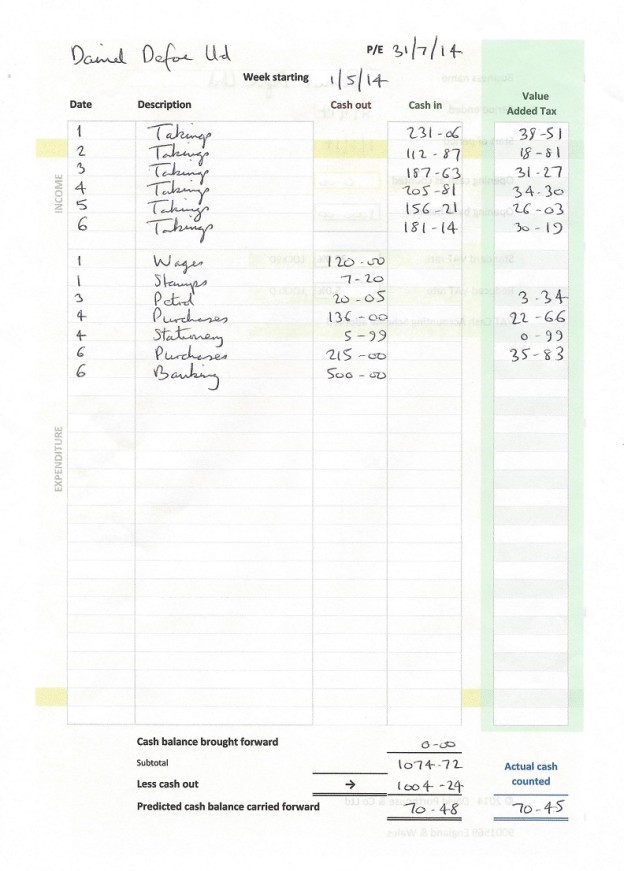

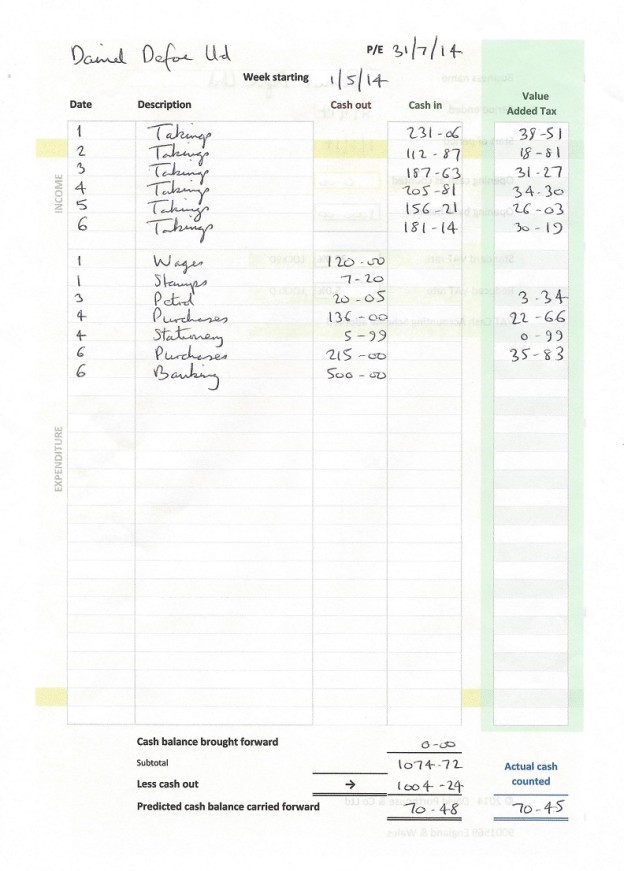

The objective of recording cash transactions is to predict how much cash is left in your cash box or till at the end of the week. If you follow the system and get it right, then you may move on to the following week. If the cash as counted turns out to be different, then just enter the actual cash counted in the blue box at bottom right and this will be taken as the opening cash balance for the following week. Here is the cash page shown full size, which is standard A4 size:

On the first cash page, please enter the starting date for that week at top centre. Please record takings first at the top, and then cash expenses and bankings below takings. You will see that the first six lines only allow takings to be entered to encourage you to do this. All the other lines allow either income or expenditure to be recorded, but please record either income or expenditure on any one line, never both. When you enter dates, you can just enter the day, since the month and year are obvious from the week starting date at the top.

If you are running a shop, then your daily takings should be recorded with the description “Takings”. Any cheques and credit card payments which you receive should be recorded at face value as if they were cash at this stage. If you pay your own cash into the business as a float, then this is described as “Capital Introduced”. If you have two or more partners, please indicate which partner has introduced the capital so that he or she may be correctly credited.

Cash drawn out of the business bank account is described as a “Withdrawal”. Cash paid in to the business bank account is described as a “Banking”. If you buy things with the intention of reselling them, these are known as “Purchases”.

At the end of the week enter the cash balance brought forward either from opening cash or last week’s actual cash counted. Add up cash in and the cash balance brought forward to get a subtotal to write in. Add up cash out and write the answer to the right of the → arrow below the previous subtotal and then subtract it to get the predicted cash balance carried forward. Count the contents of the cash box or till, and enter the total in the blue actual cash counted box. Next week, carry forward this last total if it is different.

On most bank statements you will find that the paid in column is to the right of the paid out column. This order is preserved on both the cash and bank pages of this bookkeeping system, so cash in is to the right of cash out.

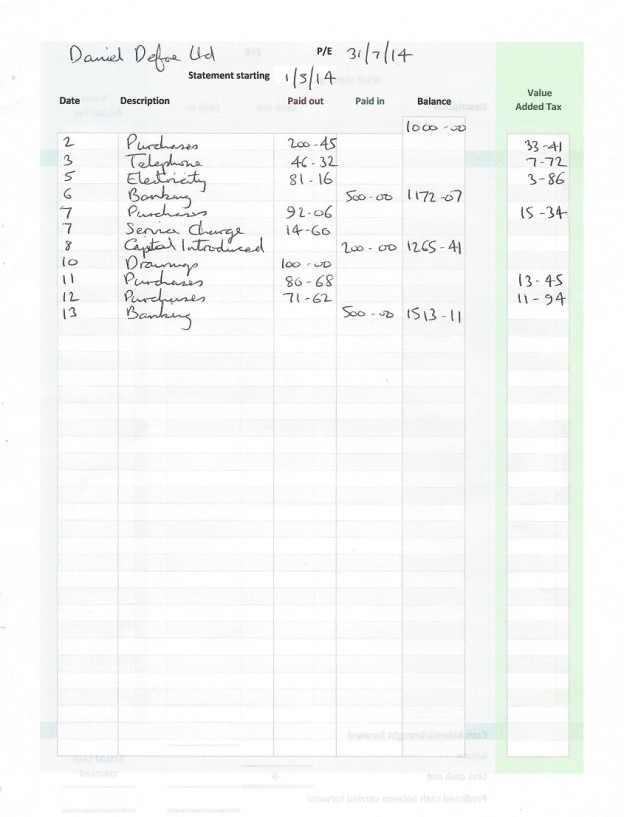

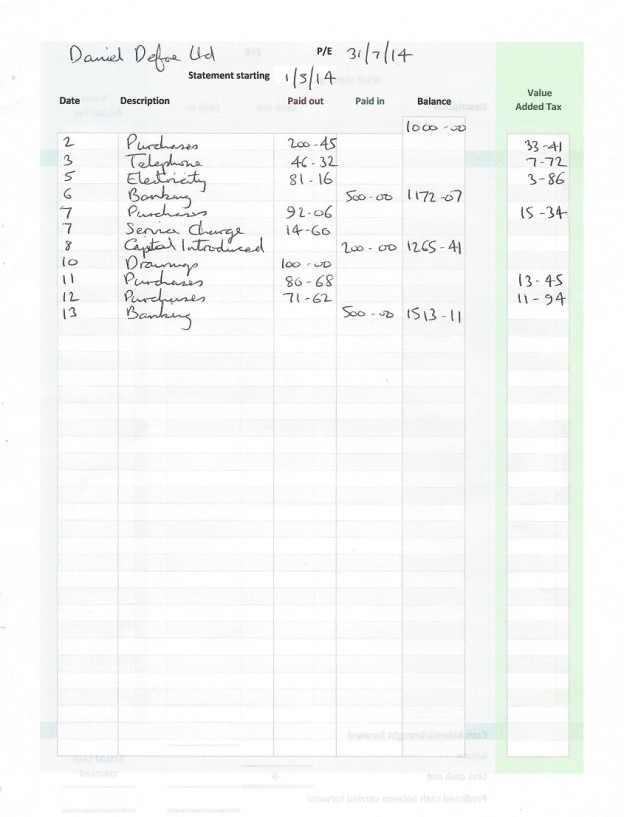

The objective of recording bank transactions is simply to produce something which looks like a copy of your bank statement. We recommend that you ask your bank to send you a statement at least once a month, and as you get each statement just copy it to the bookkeeping system. Where you have a cheque payment, say Cheque Number 000123 to Daniel Defoe Ltd, then where the bank statement says “Cheque 123″ just replace this with the name of the actual payee as it appears on the cheque book stub, “Daniel Defoe Ltd”. Alternatively, of a payment is definitely known to be for goods purchased to resell, then you may just describe it as “Purchases” as on this full-size bank page:

If you get just one bank statement per month, then please record the whole statement on a single page if you can, so that the first date on the bank statement falls on or after the date shown in the Statement starting box at the top. There is no need to be too pedantic about recording statements by the week as long as all the data is present. If you get two or more statements per month, then please just record each statement on a new page, but there is no need to be too worried about where exactly each statement should be recorded, as long as you record them in the correct order. If every cheque payment is properly identified, then this will form the basis for the preparation of the financial statements which we do for you.

Not all the running totals need be entered from the bank statement. It is suggested that you always enter the last running total as a check, and perhaps two or three others to fill in. In the example shown, the bookkeeper has adopted a rule of writing a running total next to each paid in item, and also at the end.

If you are VAT-registered, then the green columns to the right are for the entry of VAT amounts. Just enter the VAT amount in black ink without any distinction between output tax and input tax. If all your sales are at the standard rate which is currently 20%, then the VAT fraction is one sixth ( 20% / 120% = 1/6 ). Just divide each takings figure by six to get the VAT amount to write in the box at the right. You may need a pocket calculator to do this.

If you sell a mixture of items with VAT at the standard rate, the reduced rate or the zero or exempt rates, a discussion with your accountant is recommended. Some other figure will need to go into the VAT columns and this might be left to the accountant to work out.

Input tax is also entered in the box at the right hand side in the same column as output tax. When all the VAT amounts are transferred to a spreadsheet by the accountant, the distinction between output tax and input tax will be worked out automatically, coloured-coded and signed.

If all your sales are cash sales, or all your cheque and credit card receipts are passed through the cash account first, then output VAT is said to be “recognised” on the cash page. Much of the cash and all the cheques received will be paid into the bank as “Bankings”. Do not recognise output VAT on bankings since this would lead to double-counting of the VAT liability.

However, if you have other sales receipts directly to your bank account which have not passed through the cash account first of all, then you will need to record the appropriate output VAT on these receipts on the right hand side of the bank page in the bookkeeping system. Such receipts are likely to be based upon invoices issued by you where the output VAT component has already been worked out. Otherwise apply a VAT fraction such as one sixth. David Porthouse & Co will discuss all this with you before your first use of our system.

Most businesses which are registered for VAT submit quarterly returns. Our standard accounts book has fifteen pages to record one quarter’s worth of transactions. When you have written up a quarter, then please hand it in. We will transfer it to our main processing system and generate a specimen VAT return for you to approve of before making an electronic submission on your behalf. We will provide you with a new accounts book for the following quarter, which we call the roundabout system.

After four quarters of VAT returns, our main processing system will have acquired most of the information it needs to prepare your annual financial statements. We will not charge you twice for the same work. You will need to provide a full set of records, including original invoices, any new hire purchase agreements, and anything else that is relevant, before your annual accounts are prepared, but much of the work has been done already with no duplication of effort.

If you are not registered for VAT, then you may take away four books at once, but you might find it easier to operate the quarterly roundabout system just the same. If you are under the VAT threshold but getting near it, we will keep an eye on your turnover, and will do other checks as necessary.

After the year end, we suggest that you try to get your records in quickly. Leaving things to the last minute can lead to nasty surprises, and it tends to put your accountant in a straitjacket of running after deadlines rather than thinking about how to save you tax. The roundabout system as a whole should make it quite a bit easier to get your records in quickly.

If you do not own a copy of Microsoft Excel, then you may need to use a pocket calculator to add things up and work out the VAT. Accountants normally add things up twice, once going down the page and once going back up it as a double check. When you hand in the paper-based bookkeeping system, we will transfer the data from it onto a spreadsheet straight away, and charge a bit extra to do this. You could buy a copy of Excel and learn to do this yourself, and you may find that this gives a good payback ratio on your investment in Excel. Please read the page on parallel working if you are interested.

Many accounting systems ask you to classify transactions. For example, if you make a payment to Daniel Defoe Ltd, then you would be expected to say whether it is for purchases or repairs or consultancy or motor expenses or sundry expenses or some other category. With this system, you can just write the description as “Daniel Defoe Ltd” and leave it to us to look at the invoice and decide. If you happen to know it is for purchases, then you can write “Purchases” if you wish, but if you are unsure then just write the name of the payee and leave it to us. Generally it is best just to write the payee name and leave us to classify it.

HOME TOP OF PAGE SPREADSHEET SYSTEM PARALLEL WORKING WHAT WE DO QUICK DATA ENTRY